Due to a tremendous amount of erroneus information on the valuation, tax, credit and appeals […]

Category: tax

County Commissioners Address Property Revaluation

RE-PRINTED STATEMENT FROM RUTHERFORD COUNTY GOVERNMENT FACEBOOK PAGE. “We recognize that there is a LOT […]

Sticker Shock…..New Tax Appraisals Mailed Out This Week.

So the new real estate appraisals for Rutherford County were mailed out this week. If […]

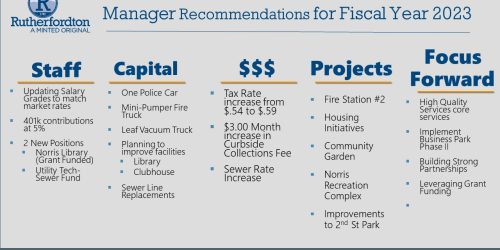

Rutherfordton Town Council Votes to Approve FY23 Budget in 3-1 Vote

By Rutherfordton.net Posted on June 15, 2022 The Town Council recently passed the Fiscal Year […]